Practical Training Requirement

Practical Training in an authorized Training Organization (TO) is a mandatory

requirement of the CA qualification. This on-the-job learning prepares chartered

accountants with the necessary professional skills, ethics, values, and attitudes.

The existing options of 3, 3.5, or 4 years of training will continue as it is with no change.

The existing options of 3, 3.5, or 4 years of training will continue as it is with no change.

However, CAF-passed/exempt and graduates will have the following additional

options for practical training:

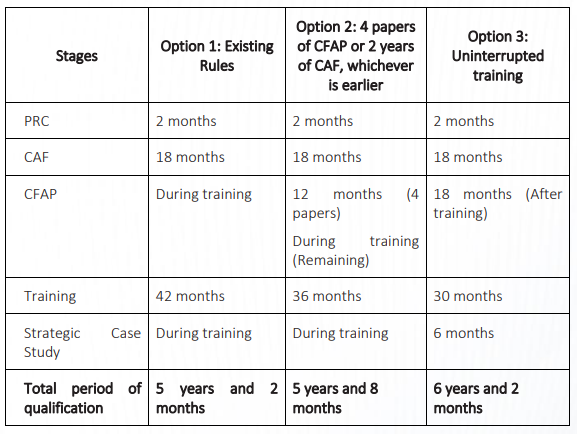

- An option of 2.5 years of 1uninterrupted training with reduced leaves.

- An option to start practical training after passing at least four papers of CFAP or two years after passing CAF, whichever comes first. Trainees choosing this track will undergo a 3-year training period with reduced study leaves.

It is important to note that once a candidate opts for any of the above options,

the decision will be irrevocable.

Additionally, an assessment by a designated person in the TO is mandatory to evaluate trainees’ training output and workplace performance.

Additionally, an assessment by a designated person in the TO is mandatory to evaluate trainees’ training output and workplace performance.

Comparative Analysis of Training Options for CAF Passed/Exempt Candidates (HSSC & A Level Route)